GameStop was forced to miss out on a big payday when it could not cash in on the spectacular rise of its stock price.

To recap, several day traders at Reddit, mainly members of r/WallStreetBets, noticed that multiple prominent hedge funds had shorts placed on the GameStop stock. A stock, and company, that has been struggling to stay afloat due to most gaming services going digital.

This means that the hedge fund managers had borrowed large volumes of the stock and sold them assuming that they would fall in price so that when they bought the stocks back to return them, they would make a hefty profit.

However, if the stock price rose, the hedge funds would have to buy them back at a loss. Potentially, an infinite loss depending on the level of price rise. And this is exactly what r/WallStreetBets put into motion.

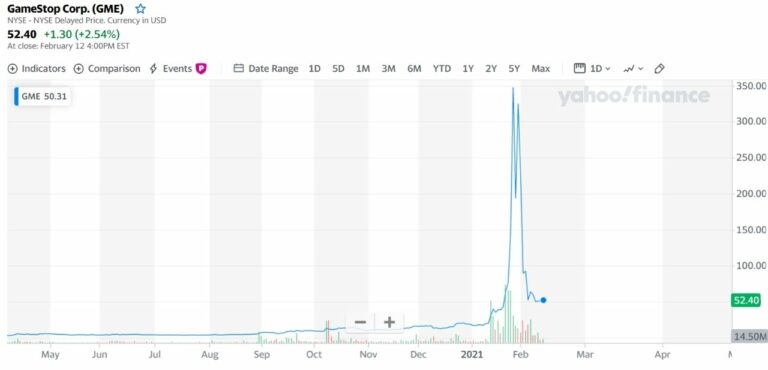

To mess with the hedge funds and take on Wall Street, Redditors began buying GameStop stock in bulk which led to an almost insane rise in GameStop’s stock price. Starting at $5 the stock went to over $300 at one point almost threatening a major market meltdown.

Naturally, this led to regulators putting added restrictions on the trading of the stock which made the stock price take a dive but not without severely impacting the aforementioned hedge funds.

Despite its own stock prices rising meteorically, GameStop wasn’t able to legally capitalize on the opportunity to bolster their cash reserves.

The company believed that, under US financial law, it would not be allowed to sell shares because it had not updated investors on its earnings. Doing so would expose it to a regulatory risk that the company couldn’t afford to handle. Because of this, GameStop wasn’t able to make any money off their stocks’ massive upswing in price.

Of course, these developments made waves all across the world, including the US Justice Department and Congress which are investigating all the activity over at r/WallStreetBets. This is due to the fact that stock price manipulation is illegal which of course warrants legal intervention.

This is a boost that an ailing company like GameStop could have really used. Being that it is $216 million in debt, it is likely to go out of business soon. However, this works out well for investors and is a lesson to other companies. Companies, globally, will have to think twice before cheating their investors with stock manipulation.

About GameStop

GameStop Corp. is an American video game retailer that sells gaming merchandise like game titles, consoles, and accessories, etc., through digital and physical formats. It is a Fortune 500 company and owns over 5,000 stores across various countries.

No Comments on US Regulators Prevented GameStop from Cashing in on Market Profits