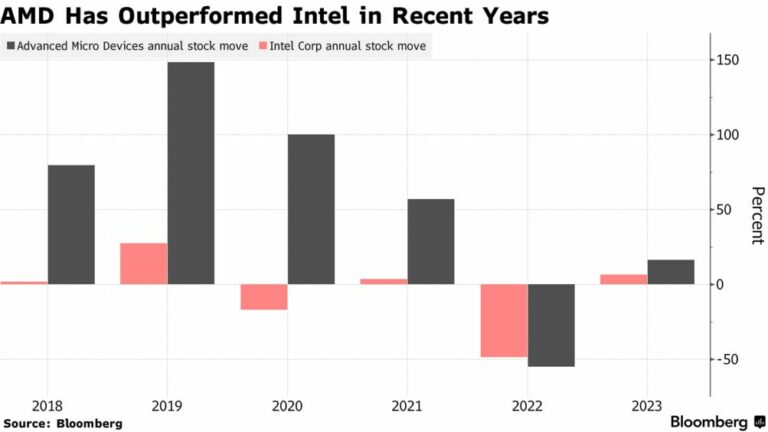

AMD finished the Q4 of 2022 with 29.6% in the x86 share, compared to 70.4% of Intel’s. AMD grew by a solid 18.6%, compared to Intel’s 81.4%.

However, the growth of AMD was marred, as confirmed by investment firm Susquehanna. Intel has reportedly done better in terms of competitiveness and has gained a significant share in the PC market.

The company’s portfolio of Intel saw an improvement from a negative rating to a neutral one, citing Intel’s highly competitive general PC portfolio as compared to AMD’s.

AMD’s success in the CPU domain and years of dominance is well known, much of which can be attributed to the steep upward trend in the performance-to-price ratio over the years.

However, Intel’s 12th and 13th Gen CPUs are tilting the scales significantly in favor of the Blue Team. This would steal some of the market shares from AMD and put them in a pole position again.

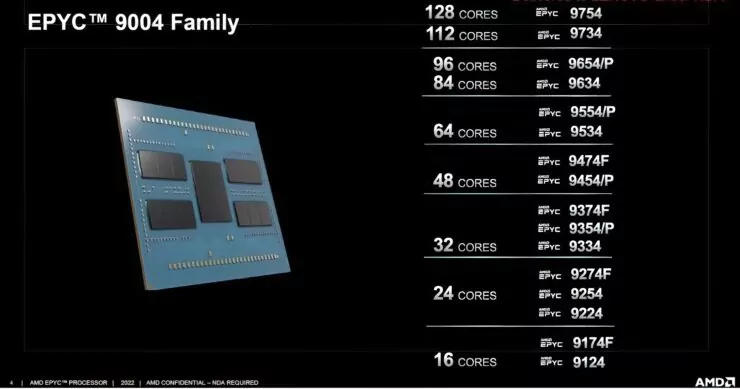

Despite the growth in Q4 by AMD, which is commendable given AMD is focusing more on the EPYC server side, Ryzen can take a hit to its market share.

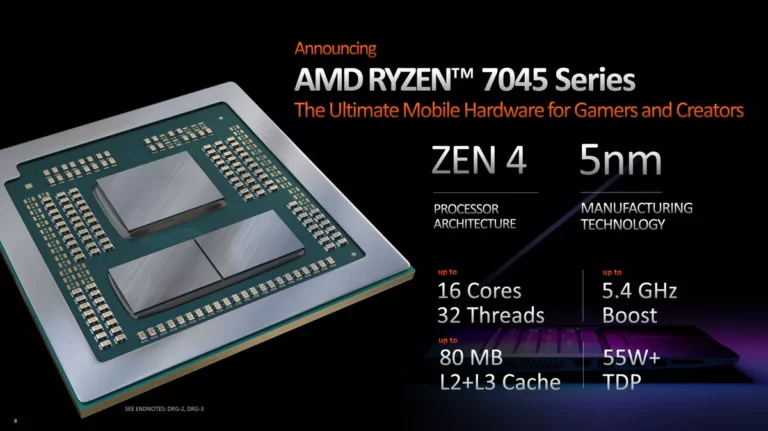

The “Dragon Range” CPUs are the flagship end of AMD’s offerings. However, only the Ryzen 9 7945HX laptops are available.

The up-and-coming X3D chips with mammoth L3 caches were the focus for the company, with the Ryzen 7 7800X3D coming out in April. The Phoenix series 7040 was also delayed, given the shift in focus to X3D chips.

AMD’s looking to switch to the AM5 platform with multiple incentives, promos, and retailer discounts for the newer X3D chips. The AM4 market is still strong, with good sales figures for the Ryzen 7 5800X3D.

As for the boys in blue, the Sapphire Rapids is expected to face stiff competition from AMD’s EPYC “Genoa”,”Bergamo,” and “Genoa-X” CPUs in the server-datacenter CPU market. All the chips are set to ship out in later quarters of 2023.

Susquehanna has reported via Seeking Alpha that AMD has put forth a better product roadmap and is executing it, and subsequent “inventory correction” has been done.

As for Intel, the 4th Gen Xeon processors have been strongly adopted by customers, with 450+ design wins and ample production to meet customer demand throughout 2023.

With both companies providing stiff competition in the market, it is anyone’s guess who will have more profits and capture a greater market share. Time and innovation by either company are going to be judges of that.

About Advanced Micro Devices

Advanced Micro Devices (AMD) is an American multinational semiconductor company headquartered in Santa Clara, California.

AMD develops computer processors and related technologies for business and consumer markets. AMD’s main products include microprocessors, motherboard chipsets, embedded processors and graphics processors for servers, workstations, personal computers and embedded system applications.

No Comments on Intel takes market space from AMD, dubbed more competitive by Susquehanna